Tokenizing the actual real estate. Real-time appraisals and analytics.

Real estate is unique; it’s non-fungible and should be represented as such. But real estate also has numerous ancillary items (deed, title, insurance, income streams, etc.) that must be accounted for. Recent innovations in crypto have focused on composability – the ability for two or more things (often, smart contracts) to interact. Composability allows for exciting new use cases, as protocols and applications can now plug into each other like Lego blocks.

The next logical step is to dematerialize real estate using the composable non-fungible token standard ERC-998, whereby these assets can own and control other fungible and non-fungible tokens (NFTs).

Composable NFTs provide tangible value to real estate owners and investors by providing immutable evidence of ownership and asset performance via crypto tokens that can seamlessly interact in the decentralized finance (DeFi) realm. Critically, NFTs do not fall under the same regulatory oversight as fungible tokens – alleviating the need for costly intermediaries and eliminating the associated time delays.

As set forth below, composable NFTs dematerialize real estate and, in doing so, solve the problems that have been plaguing the industry for centuries. This is the real estate market of Web3.

PART I

A Bit of History.

Mistakes of the past.

Real estate is an asset class that everyone interacts with throughout their lifetime as users, owners, and/or renters, and, sometimes, also as operators, developers, and/or renovators. Yet, in a world where most things can quickly and easily be done remotely, real estate transactions remain uncertain, costly, complicated drawn-out processes. Entire satellite industries have evolved for facilitators – lenders, debt brokers, analysts, real estate brokers, lawyers, government regulators, inspectors, appraisers, title agents . . . the list goes on.

A typical real estate deal (whether residential or commercial) involves research, an escrow account, negotiating the price, obtaining title searches and insurance, hiring legal counsel, completing all third-party inspections, negotiating closing fees, negotiating and securing debt, removing any contingencies, completing the legal documentation, and funding. Amazingly, it often takes the same amount of paperwork to close a $50,000 deal as it does to close a $50,000,000 one. Only a facilitator could tell you with a straight face that this is a healthy process.

Want to flip the asset in the near future? The entire process starts again.

The monolith that is the real estate sector is thought to move slow because the focus is on getting it right. After all of the appraisals and third-party inspections, at least the parties know that the asset is solid; they paid the right price. But, in reality, this couldn’t be further from the truth. The current model has a critical flaw – lagging data.

Most markets are based off well-known principles of supply and demand, and real estate is no exception.

Owners, developers, and renovators form the supply side of the market, while owners, users, and renters form the demand. Of course, the theory of supply and demand assumes that markets are perfectly competitive. This implies that there are many buyers and sellers in the market, none of whom have the capacity to significantly influence the price. This often fails to account for many real-life situations, as individual buyers and sellers do have the ability to influence prices.

Microeconomics studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. A number of modifications must be made to standard microeconomic assumptions and procedures in order to apply simple supply and demand analysis to the real estate markets. In particular, you must additionally account for durability, heterogeneity, high transaction costs, lengthy delays, immobility (other than mobile real estate), and its dual nature as both an investment and a consumption good.

Residential Real Estate can be analyzed using supply (as determined by the cost of various inputs, such as electricity and building materials, the price of the existing stock of houses, and the technology of production), demand (as driven by demographics and psychographics), and a stock / flow basic adjustment mechanism.

Commercial Real Estate, on the other hand, is far more complicated, further taking into account asset pricing, market employment, credit, consumer confidence, housing numbers, inflation, income, and retail strength. A commercial real estate investment involves cash flows, outflows, timing of cash flows, and risk, which can be dependent on market conditions, current tenants, and the likelihood of year-over-year lease renewals and successful servicing.

One would assume that in today’s data-driven world oracles would routinely provide real-time analytics for each of these factors, yet that is not the case. Instead, the commercial real estate market relies on appraisals – a lagging indicator.

There are 3 methods commonly used in commercial property appraisal:

Cost

Approach

Sales Comparison

Approach

Income Capitalization

Approach

The Cost Approach is not very popular, as it merely assumes that the value of the commercial real estate is equal to the cost incurred to construct it (i.e., the replacement cost). Thus, any future cash flow or profits from the property are not accounted for in advance, making this methodology rather unreliable.

The Sales Comparison Approach (aka Market Data Approach) involves selection of properties with similar characteristics and in the same (or similar) market area. The value of the property is then inferred from the sales data of these industry “comps.” This approach, too, has proven unreliable in and of itself, although it is often incorporated with an Income Capitalization Approach for a blended appraisal.

The Income Capitalization Approach assumes a positive relationship between the current value of the property and the expected cash flow that the property should provide in the future. It also simultaneously assumes a negative relationship between the current value of the property and the probable risks involved in achieving the expected future cash flow. Thus, de-risked property capable of generating sustainable cash flow becomes the prize. The most important part of this method is that the analysis of the property must include its ability to provide a return on the capital investment.

Now that we have an overview of the real estate space, let’s shift our gaze to the tech arena.

Understanding this Exponential Age is, at once, the most basic and the most powerful tool in one’s arsenal.

The term Exponential Age has been tossed around since we began understanding exponential technologies – those that, as they advance, accelerate the progression of seemingly disparate technologies and expand what’s possible at a pace that’s difficult to comprehend. In math, an “exponent” is the number of times a number is to be multiplied by itself. Thus, “exponential growth” is when a mathematical function’s current value is proportional to its rate of change.

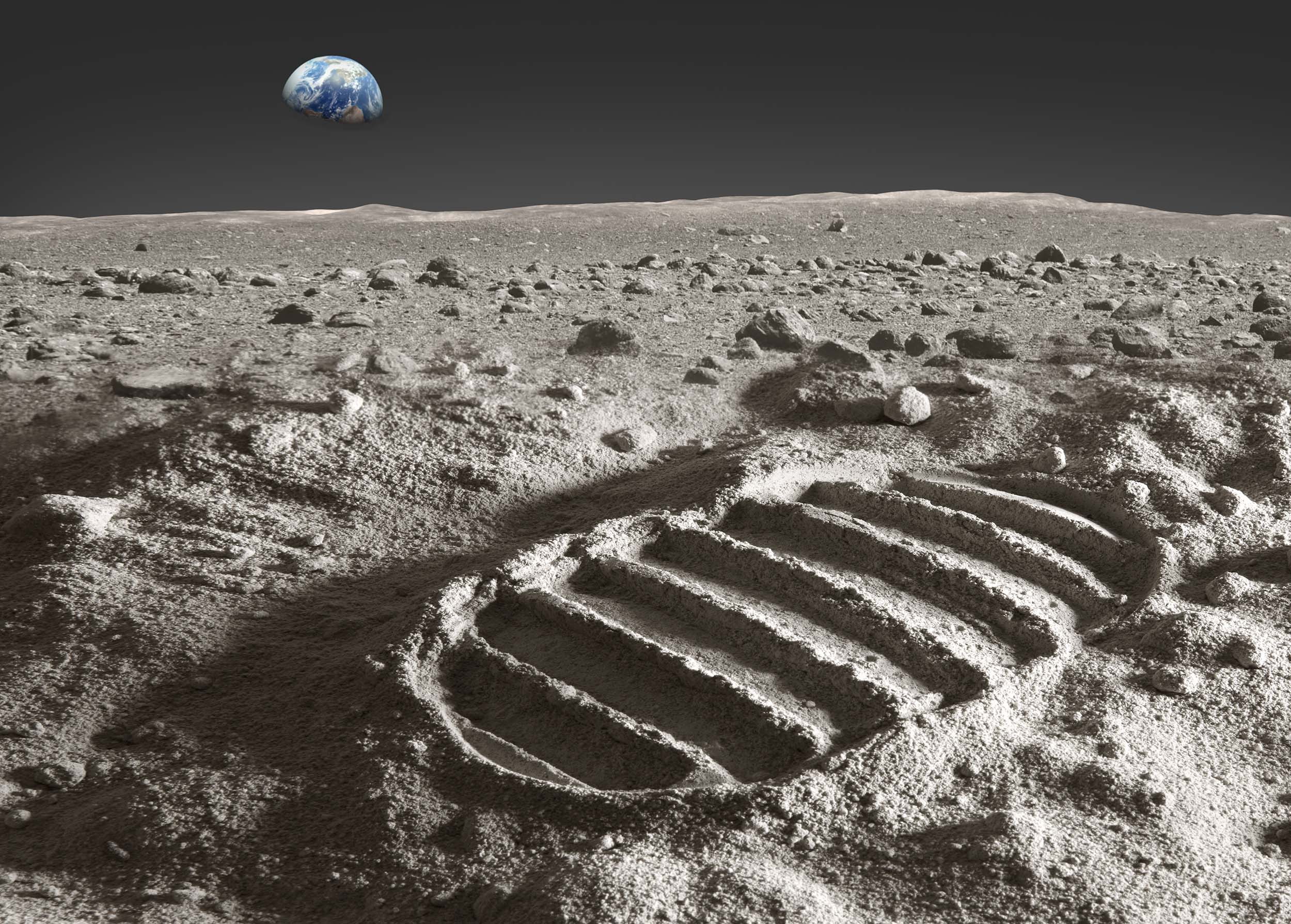

For example, if someone took 10 linear steps (1, 2, 3, 4, 5, etc.) they get to 10. But, if they took 10 exponential steps (1, 2, 4, 8, 16, etc.) they get to 1024, or about half a mile. If someone took 30 linear steps, they’ve gone 30 yards. But, if they took 30 exponential steps, they’ve gone to the moon and back. Get the picture?

For example, if someone took 10 linear steps (1, 2, 3, 4, 5, etc.) they get to 10. But, if they took 10 exponential steps (1, 2, 4, 8, 16, etc.) they get to 1024, or about half a mile. If someone took 30 linear steps, they’ve gone 30 yards. But, if they took 30 exponential steps, they’ve gone to the moon and back. Get the picture?

Other concepts play into this picture, as well. Setting aside for a moment whether it’s correct, Moore’s Law states that overall computer processing power doubles every 2 years (thus, experiencing bi-annual exponential growth). And the Law of Accelerating Returns, as posited by Ray Kurzweil, states that the rate of progress in an ecosystem that learns via evolution (i.e., iteratively) increases exponentially. The more advanced such a system becomes, the faster is rate of progress grows.

Exponential technology, thus, refers to innovations progressing at a pace with or exceeding Moore’s Law that evidence a renaissance of innovation, invention, and discovery and have the potential to affect billions of lives.

Linear thinking has been hardwired in our brains for millennia. But, today, we’re living in an exponential era.

Many people think of Bitcoin or conjure images of a volatile wild west of crypto when someone says blockchain, but the truth is it’s just the next logical step in the history of computing models that have had steady breakthroughs every couple of decades. During WWII, we had the first computers that were used to crack the Nazi’s secret code. Several decades later, we had the first mainframe computers for commercial use – completely siloed systems. In the 1970s, Apple and others gave us the personal computer – still siloed. Then, in 1990, mass adoption of the internet connected these computers – we were no longer siloed. This was Internet 1.0 (read only).

Internet 1.0 spanned 1993 – 2002 and primarily encompassed indexed search.

It brought us the likes of Google, Amazon, PayPal, Pets.com, eBay and others. These were static sites, portals, email, chat, and finance facilitators and physical goods marketplaces – all characterized by low bandwidth and limited hardware. Web 1.0 lived primarily on desktop computers. 2

Then came the advent of the smartphone and mobile computers – still connected and now able to sync with each other, but only via some form of centralized reconciliation. This was Internet 2.0 (read and write).

Internet 2.0 spanned 2002 – 2018 and thrived on mobile devices.

It focused on user generated content, streaming media, and location-based services and introduced us to social networking, broadband, mobile, cloud, SaaS, and gig economy marketplaces. Artificial intelligence and machine learning dominated this period of “free” access, where the subtle, imperceptible change in your thoughts and actions was the real product. Enter Facebook, Instagram, Twitter, AWS, Uber and others. 2

Now, we have blockchain where the database and the network are fused together to create in-sync networked databases without the need for a centralized authority. This has given rise to Internet 3.0, or Web3 (read, write, and own).

Web3 began in 2018 and is poised to dominate this 2020 decade.

Interestingly, Web3 coincides with the advent of our 4th Industrial Revolution which is being driven by artificial intelligence, DNA sequencing, energy storage, and robotics, in addition to blockchain technology. Thus, as you would expect, this Web3 period is characterized by artificial intelligence and machine learning as a service, bioengineering, sensors, IoT devices and 5G, crypto, space travel and manufacturing, and clean energy. While it’s too early to say who will dominate this period, it’s fairly safe to know that Bitcoin, Ethereum, Starlink, OpenAI and others will play pivotal roles. (Yes – we’re all aware that Bitcoin, Ethereum, et al were introduced during Web2, but they required maturing and it’s only in this new Web3 world that they can comfortably reign.)

Traditional client / server architecture consists of multiple clients tied to one or more servers. These servers are centrally owned by various entities. The internet as most people know it is essentially large numbers of these closed systems interacting with each other.

CENTRALIZED

DECENTRALIZED

Blockchain architecture is different. It consists of peer-to-peer networks with clients (that send, receive, and read transactions) and validators (that are incentivized to secure the network). These peer-to-peer networks are always open and available and no centralized trusted authorities exist to block transactions or deny access – thus, often referred to as trustless.

Quite simply, a blockchain is a database (a collection of data stored electronically) with a key difference in its storage structure. A blockchain collects information together in groups (blocks) that hold sets of information. These blocks have certain storage capacities and, when filled, are chained onto the previously filled block – hence, block-chain.

The first block is always known as the genesis block, and for security new blocks are always stored linearly and chronologically – i.e. added to the end of the blockchain – once done, it’s extremely difficult to go back and alter the contents of a previous block unless the majority agrees to do so. This is thanks to hash codes – mathematical functions that turn digital information into a string of letters and numbers. Each block contains its own hash, the hash of the block before it, and a time stamp. Thus, hacking a blockchain would require that the hacker simultaneously control and alter 51% of the copies of the blockchain so that their new copy becomes the majority copy and, thus, the agreed-upon chain – not to mention having to redo all blocks as they would now have different timestamps and hash codes. Not an easy feat.

At the highest level, there are 4 basic layers of blockchain computing:

Base Layer (Layer 0) – Hardware and Networking

Layer 1 – Consensus and Settlement

Layer 2 – Smart Contracts

Layer 3 – Wallets and Interfaces

Almost every industry can benefit from blockchain technology. Shepherd is a Layer 3 decentralized application (dApp), bringing the trustless and secure nature of blockchain transactions to the real estate sector.

The building blocks of our new crypto-backed economy are tokens. Tokens live on peer-to-peer blockchain networks and are, essentially, just code. The key aspects are that they’re digitally native, programmable, and cryptographically secure.

Tokens come in 2 – really, 3 types:

Fungible

(interchangeable)

Semi-fungible

(fungible within a class)

Non-fungible

(unique)

While fungibility isn’t something we typically think of, it’s a pretty straightforward concept. Fiat currency is the best example of a fungible item. If someone is lent $50, they can be repaid with any $50 bill – it doesn’t have to be the original $50. Hence, cryptocurrencies, stable coins, and central bank digital currencies (CBDCs) are all fungible tokens.

Semi-fungible items get a little grey, as fungibility can be subjective. Think of a ticket on a train. One person might consider a first-class ticket semi-fungible – it could be replaced with any other first-class ticket without harm. While another person might consider the specific window seat that they booked in first class to be unique. Semi-fungible items can also represent those within a class – i.e. useful items within a video game, such as weapons or potions.

Non-fungible items, in contrast to the fiat currency example above, are unique. If someone is lent a Rolex, they can only return that exact watch. It’s one of a kind, as denoted by its serial number and unique past. While most people have been baffled by the emergence of non-fungible tokens (NFTs), from a crypto perspective, they represent the vast majority of, well, everything. We’ve had digital items for years, just without immutable provenance – tickets, domain names, social handles. Those are all NFTs. Now think about all of the non-digital, but still unique items that exist. Those are also NFTs – or, at least, they can be represented by an NFT.

The ability to represent anything (object, entity, or person) by a token is where it gets interesting.

As mentioned previously, tokens are the building blocks of our new crypto economy. And unlike other digital assets, tokens are digitally native (existing on blockchains) programmable, and cryptographically secure. This programmable aspect of tokens makes them the perfect medium to represent all other physical and digital items. Quite simply, public blockchains will be the title registry for everything of value.

Over the past few years, hundreds of companies have emerged offering tokenization and associated marketplace services. Many of these have focused on real estate – moving the capital table of a real estate asset / project on chain via conversion into fungible tokens. In theory, this approach has numerous advantages. Most capital tables are, shall we say – untidy, and could benefit from the transparency and immutable aspects of a distributed ledger. Investors can feel confidence, knowing that their portion of the capital stack is properly documented and (assuming the proper legalese has been encoded into the smart contract) that they can sell it simply by transferring their representative token(s) to another. Further, because the transfer has been pre-approved and any requisite rights of first refusal dealt with via code, an investor could then offer their shares on private and public marketplaces – in essence, turning their tokenized private investment into something that looked a lot like a public stock.

That’s when the regulators got involved – to “protect” everyone, of course. These fungible tokens were deemed securities in the United States, requiring registration with the SEC and extensive investor diligence and compliance. Securities trading and banking licenses came into play, and the timeline to tokenize went from minutes to months. As one might imagine, this took a process that could be enacted for little to no money and escalated it into the hundreds of thousands of Dollars.

The real estate tokenization market to-date has failed for one very simple reason – it never actually tokenized the real estate.

Real estate is unique; it’s non-fungible and should be represented as such. What these businesses have been tokenizing is the capital table – the underlying security interest(s) in the real estate. Hence, the myriad of regulatory compliance issues that have plagued the industry.

Tokenizing the equity is insufficient, as it fails to provide adequate value to asset owners and investors while saddling them with additional costs and compliance requirements. The contractual bundle of owner / investor rights is represented as a fungible token, the corresponding capital table is recorded on chain, and all subsequent transfers are recorded on chain via the token movement. In theory, the investor should be able to trade their asset faster and easier and the JVCo should be able to transparently monitor and record the activity. But is a legitimate benefit or is this simply another layer of complexity added to the same process?

Innovation is never born simply by replicating old structures in a new way. We need to explore and create new structures that capitalize on what wasn’t previously available / the intrinsic value of crypto and DeFi.

Real estate transactions have very specific pain points – namely, reliance on lagging valuation data and the need to engage facilitators to validate the asset valuation and complete the transaction. Tokenizing the equity interests fails to address any of these, as the transaction cycle itself remains unchanged. Asset valuations aren’t a part of this equation and the need to engage multiple facilitators actually increases. Occam’s razor teaches that the simplest solution is usually the best. But here is an industry that hasn’t simplified anything at all. Not a great business model, as the market has taught.

It’s no wonder that while these tokenization companies still exist, many have since shifted their business model to serving as end-to-end digital investor onboarding, compliance, and management, including transfer agent services – in essence, a tokenized CrowdStreet with the only difference being that tokenization adoption has been minimal, while CrowdStreet will deploy over $1.5 billion this year. The thought has been to embrace the digital security aspect, charge for handling compliance, expand the same investor onboarding process to the private equities market, focus on institutional clients, and spin up alternative funds to sell them crypto and DeFi services totally separate from their real estate business. Meanwhile, the real estate industry is left, essentially, where it always has been.

So, if fungible tokens aren’t the answer for real estate, what about NFTs? The emergence of NFTs this crypto cycle has focused on art, film, music, creator coins, personal income streams, and sports. With these tokens, many have touted blockchains making the leap from the financial to cultural realm. Tyler Winklevoss has said that NFTs are “monetized memes”. Note that this was praise, not an insult. Society grows and evolves via memes – they’re more important than you might think.

But, what about the leap to the business realm? Cameron Winklevoss has said, ultimately, NFTs will authenticate the world. We couldn’t agree more.

PART II

A Better Future.

Fast.

Transparent.

Accurate.

What has appeared from the outside as chaotic volatility in the crypto space is well understood by those within as requisite cycles of birthing. Each brings maturity (ICOs were a disaster, but look at today’s launchpads) and, equally as important, the funding for each era of innovation. Today’s tool sets are greater than ever before – layer 1 blockchains, layer 2 scaling solutions, multi-chain functionality, decentralized exchanges, wallets, storage protocols, developer protocols, lending protocols, and stable coins.

The world is at a tipping point – a gradually, then suddenly moment. With the advent of central bank digital currencies (CBDCs), it will become a requisite that everything can now participate in this crypto-powered digital asset realm. That means that every asset, every person, every entity, every municipality, every income stream, and every experience will become tokenized. As one of the oldest, largest asset classes on the planet, real estate will be no exception.

In this new era, real estate will trade as composable NFTs with non-fungible tokens interacting with their fungible cousins in a seamless ecosystem.

Smart contracts are Ethereum’s true innovation, allowing for instant and verifiable transactions. A smart contract is simply a program that runs on the Ethereum blockchain – a collection of code (its functions) and data (its state) that resides at a specific address on the Ethereum blockchain. Note that they are not controlled by a user, but instead deployed to the network and run as programmed. User accounts can then interact with a smart contract by submitting transactions that execute a function defined on the smart contract. Rules are defined and then automatically enforced via the code. 3

The key is that these smart contracts are capable of being programmed to interact with each other. In other words, they are composable. Composability is one of the great innovations to-date in crypto – allowing for exciting new use cases, as protocols and applications can now plug into each other like Lego blocks. The money Legos of DeFi are one of the great early advances in composability.

Token standardization is critical to composability. ERC-20 introduced a technical standard for fungible tokens, providing a list of rules that all Ethereum-based tokens must follow. ERC-20 defines six basic functions for the benefit of other tokens within the Ethereum ecosystem, including how data is accessed and the method of transfer.

ERC-721 was the first technical standard for representing non-fungible tokens. This standard builds upon ERC-20, adding mapping of unique identifiers to addresses and a permissioned way to transfer these assets. ERC-721 was first pioneered by CryptoKitties – the breedable collectibles that continue to enthrall their owners.

A semi-fungible token standard emerged soon thereafter, brought forth by the Enjin team. ERC-1155 introduced classes of unique assets – i.e., a video game can have 1,000 swords or suits of armor. The obvious usefulness here is efficiency in not having to transfer multiple ERC-721 tokens, but instead easily being able to call a specific quantity with a single operation. It should be noted that this increased efficiency sacrifices data, as the history of any individual sword or suit of armor can no longer be traced.

Most recently, the composable NFT ERC-998 standard was introduced. ERC-998 provided a template whereby NFTs can own other non-fungible, as well as other fungible assets. Sticking with the CryptoKitties example, a kitty can own a scratching post and a feeding dish (which may contain some amount of fungible “chow” tokens). Selling the cryptokitty means selling all of its belongings, but those belongings may also be bought and sold individually by the owner of the cryptokitty. 4

Tokenizing the actual real estate.

Similarly, real estate should utilize this ERC-998 standard. Any real estate asset can quickly and easily be tokenized as an NFT by coding a few key pieces of data. That NFT can now have additional assets within its ownership control, such as the title, deed, or insurance policy (each of which are an NFT in their own right). In the case of commercial real estate, the associated property and operating entities might also be NFTs – with their associated accounts, income streams and holdings as NFTs and fungible tokens. As one can quickly envision, these composable NFTs are primed and ready to plug and play in the DeFi arena.

Real-time appraisals and analytics.

The true game-changing opportunity lies in the integration of real-time data to properly value and track these non-fungible tokenized real estate assets. Instead of relying on the historic data contained in appraisals and other third-party reports, live data feeds can now be linked to the asset – constantly validating and re-enforcing census, employment, income, expenses, and a host of other critical information. Artificial intelligence can spot trends and market variances, as algorithms highlight real-time valuations based on immutable data.

Thus, composable NFTs provide value to asset owners and investors by providing immutable evidence of ownership and asset performance via crypto tokens that can be seamlessly plugged into the DeFi realm. Critically, NFTs do not fall under the same regulatory oversight as fungible tokens – alleviating the need for costly intermediaries and eliminating the associated time delays.

We now have a blueprint for a market that truly addresses the myriad of real estate transaction issues and eliminates the need for facilitators. This is the real estate market of Web3.

PART III

A New Market for a New World.

The tokenization of real estate as composable NFTs is real

and closer than one might think.

Shepherd is the gateway to this bold new world.

The market opportunity is two-fold:

- Tokenizing residential and commercial real estate via composable NFTs and providing the existing ecosystem(s) with real-time asset valuation and underlying data; and

- Operating a marketplace for these NFT-backed real estate assets, ultimately eliminating the need for facilitators

The first recognizes the existing facilitator-heavy ecosystem as customers, while the second (itself a mature, fully tokenized ecosystem) eliminates the need for them entirely. Put another way, the first solves the critical flaw of lagging data, while the second goes beyond and further solves the problems of uncertainty, cost, complication, and time.

Trustless, Real-Time Appraisals

While the tokenization of the asset per the ERC-998 standard will, itself, confer numerous advantages, Shepherd’s true differentiator is the ability to convey trustless, real-time asset valuation utilizing proprietary appraisal algorithms blending the Income Capitalization and Sales Comparison (Market Data) Approaches. Live market, asset, IoT, and 5G feeds will validate and re-enforce the underlying data used in the appraisals – including census, employment, income, expenses, demographics, psychographics, competitive sets, and vast amounts of other critical information. These integrations will continue to grow over time, providing even greater swaths of data to train Shepherd’s AI.

AI meets Blockchain

AI training costs are dropping at a rate of 68% per year. That translates to software that is better, cheaper, faster, and more creative – in other words, greater insights paired with a greater user experience. Simultaneously, blockchain technology is rapidly evolving – laying the requisite infrastructure rails for our new 4th Industrial Revolution economy. The next advances will take place at the intersection of AI and blockchain – incorporating both on and off-chain data in a holistic ecosystem.

In addition to the behind-the-scenes learning and filtering to better address its user’s needs, Shepherd is designed with an AI-driven ephemeral insights panel that can be shown or closed at the user’s discretion – thanks in part to the ability to digitally extract, query and analyze in real time large and diverse sources of structured and unstructured data. As always, the most exciting discoveries will come from what isn’t being looked for. Shepherd is a new paradigm – and once adopted, the global asset data flow will provide fertile hunting ground.

In Summary

Shepherd Markets provides a regulatory-compliant solution to tokenize both residential and commercial real estate. Real-time data and a solution built for Web3 bridges the gap between old world assets and our new digital reality.